Why Cultural Placement Is the Real Growth Strategy for Food & Beverage Brands

The brands that will define the next decade of food and beverage won’t be the ones producing the most content. They’ll be the ones that understand where culture is moving before it arrives – and position themselves inside it with precision. Because in the end, growth doesn’t come from being seen everywhere. It comes from showing up exactly where you belong.

The food and beverage industry is producing more content than ever.

Recipes. Reels. Product drops. Founder stories. Behind-the-scenes clips. Trend reactions. Seasonal campaigns.

Feeds are full.

Shelves are full.

Calendars are full.

But consumer attention isn’t.

The problem isn’t how much content brands create. It’s where they exist culturally.

The brands winning today aren’t the ones posting the most. They’re the ones that appear in the right moments, environments, and narratives. Because in modern marketing, distribution of meaning matters far more than distribution of media.

Content Doesn’t Build Appetite. Context Does.

Most food and beverage content is produced in isolation from real-life behavior. It’s created for platforms, not for people’s routines, rituals, or identities.

Consumers don’t remember posts about products.

They remember when a product showed up where it naturally belonged.

Think about how:

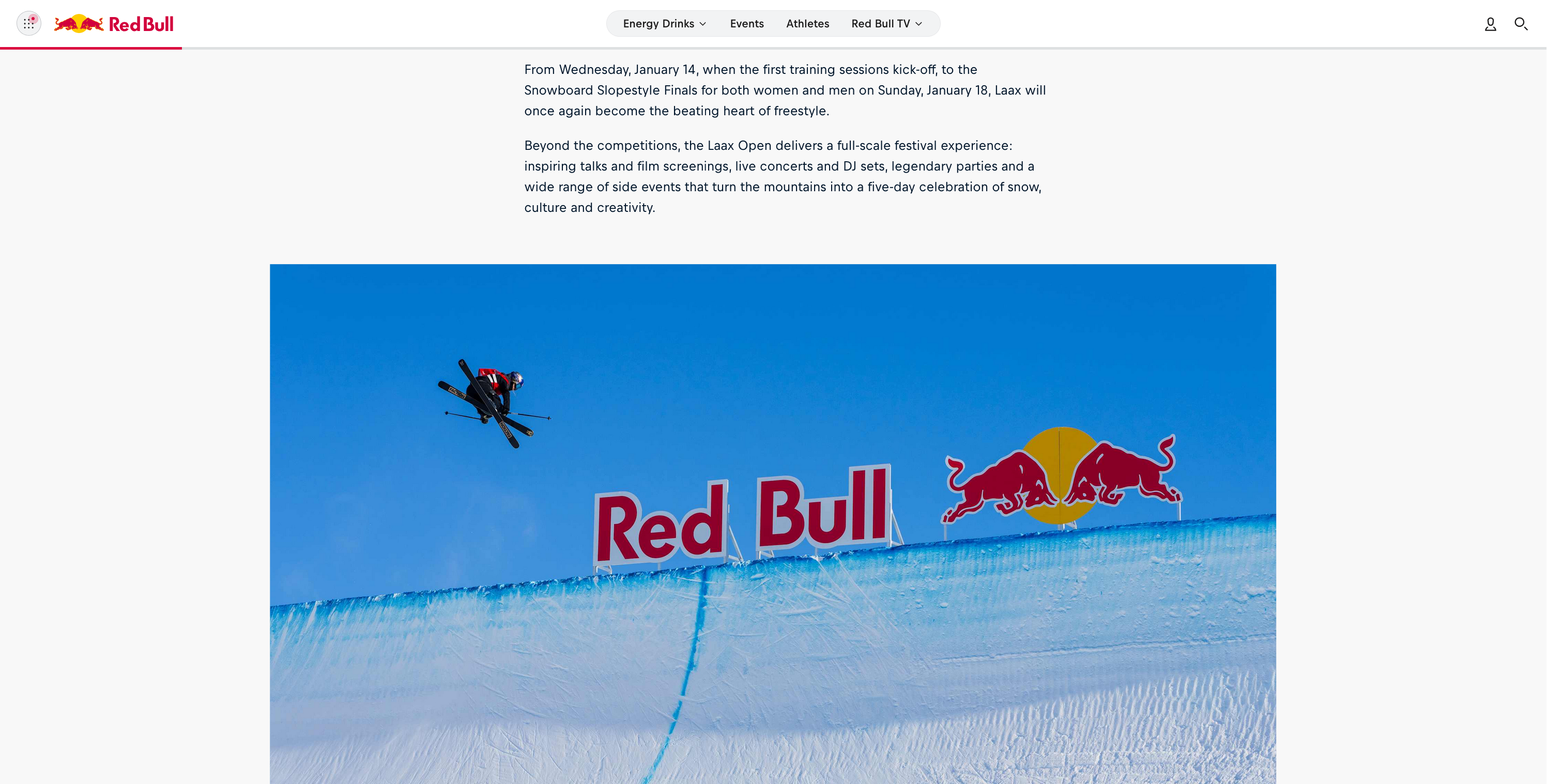

- Red Bull became synonymous with extreme sports culture – not because of ads, but because it embedded itself into the environments its audience already valued.

- LaCroix didn’t explode because of content volume; it became culturally visible when it appeared organically in lifestyle spaces associated with wellness, minimalism, and modern aesthetics.

- Liquid Death didn’t win through frequency – it won by inserting itself into music, counterculture, and irreverent humor ecosystems that matched its personality.

That’s not exposure. That’s alignment.

Cultural Placement Is the Real Growth Lever

For CPG brands, cultural placement in food and beverage marketing means intentionally embedding products into environments where meaning already exists:

- shows and entertainment ecosystems

- social rituals and occasions

- lifestyle identities

- retail environments

- communities and subcultures

It’s not about visibility. It’s about credibility.

Consider:

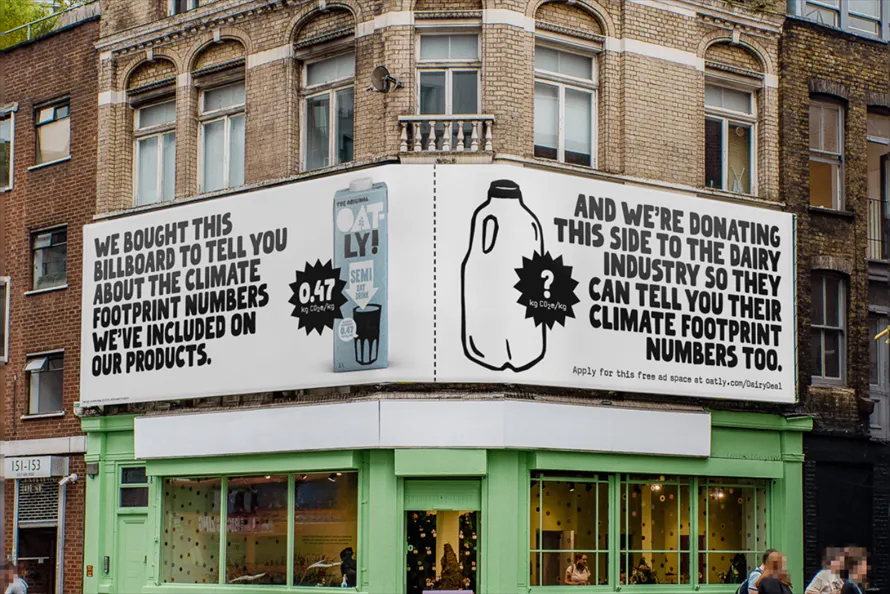

- Oatly didn’t grow simply because of oat milk demand. It grew because it embedded itself into café culture, barista communities, and design-forward urban environments that validated its identity.

- Prime Hydration spread through creator ecosystems and youth culture before traditional retail dominance. Cultural distribution preceded physical distribution.

- Topo Chico became a status beverage in creative and entrepreneurial circles long before mass audiences adopted it.

A product placed inside the right cultural context borrows trust from that environment. Consumers don’t perceive it as advertising. They perceive it as belonging.

And belonging is what drives trial.

Why More Content Often Backfires

When a brand lacks cultural relevance, producing more content rarely fixes the problem. It usually magnifies it.

Posting more does not create demand.

Relevance creates demand.

Compare:

- Dozens of daily posts from a generic snack brand with no identity

vs. - A single strategic placement of Reese’s Pieces in E.T. (Elliot uses to lure ET), which permanently linked the product to a cultural moment and drove massive product and merchandise sales.

One culturally aligned appearance can outperform months of social output because it embeds the product into a consumer’s mental world. Instead of asking people to imagine where the product fits, it shows them.

The Brands That Win Understand Occasion, Identity, and Context

The strongest food and beverage brands don’t just ask how to market their product. They ask where their product belongs.

They analyze:

- when people would realistically consume it

- who would naturally reach for it

- what lifestyle it signals

- what environment validates it

- what story it supports

For example:

- Olipop succeeds not just because it’s a healthier soda, but because it shows up in wellness-curious environments where nostalgia and modern health identity intersect.

- Celsius grew by embedding itself into fitness culture and gym environments where its functional promise felt credible.

- Spindrift aligned with ingredient transparency culture and clean-label communities that reinforced its authenticity.

When a product appears in the right setting, it doesn’t feel placed. It feels inevitable.

Cultural Fit Is Stronger Than Shelf Placement Alone

Retail distribution matters. But cultural distribution is what makes retail work.

Consumers don’t buy products simply because they see them on shelves. They buy them because they’ve already seen them somewhere meaningful.

In culture.

In stories.

In environments that signal identity.

That’s why Whole Foods placement alone doesn’t build a brand – but Whole Foods placement combined with cultural credibility does. The shelf confirms what culture already suggested.

By the time a consumer encounters the product in the store, the decision has often already been made.

The Future of CPG Marketing Is Embedded, Not Broadcast

Food and beverage brands that rely solely on content production are competing in a volume game they cannot win. There will always be more posts, more videos, more ads.

But there will never be unlimited cultural moments.

Brands that understand this shift are moving away from constant publishing and toward strategic presence. Instead of asking “What should we post today?” they ask:

Where should we exist so that people believe in us?

Because modern consumers don’t want to be marketed to. They want to encounter brands that feel native to their world.

And in food and beverage, nothing drives growth faster than a product that feels like it already belongs in someone’s life.

Understanding cultural placement isn’t a creative instinct. It’s a strategic discipline – one that requires reading behavior, environments, and meaning systems as carefully as data dashboards. The brands that recognize this shift early won’t just market better. They’ll become part of culture itself, which is where real brand equity is built.

Cultural placement is quickly becoming the most underutilized growth lever in food and beverage. While most brands compete for attention, the smartest ones compete for context – because context determines credibility, and credibility determines demand. The future of brand growth won’t belong to the loudest marketers. It will belong to the sharpest observers of culture.

Products succeed when they stop acting like marketing and start behaving like culture.